September 25, 2024 10:53am

Investor Perspective: what to know about the Federal Reserve interest rates cut

Rob Hawkins, Chief Investment Officer for Independence Bank, shares his perspective, insights, and opinions on the recent cut of interest rates and what it will mean for the economy in the year ahead.

Fed Cuts 50bps (0.50%), “Strong Start” to “Recalibrate” to Lower Rates

Market Reaction: The S&P 500 reached a new all-time high (5,690) upon announcement, but retreated to a loss at close (5,618 -0.3%) yesterday. Interest rates increased and the yield curve steepened. Despite the larger than expected 0.50% cut, stock and bond markets backed off of recent bullishness looking for stronger forward messaging on rate cuts.

“Strong Start”

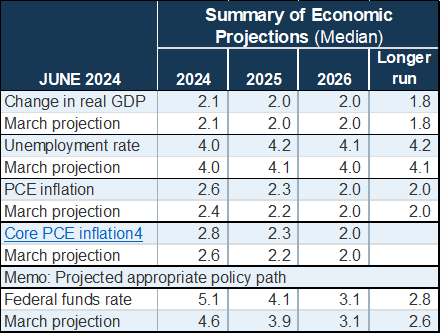

On Wednesday at 2PM the Federal Reserve announced it would cut the Fed Funds rate by 50bps (0.50%), ending the fastest and steepest level of interest rate tightening since the early 1980s (See Summary of Economic Projections [SEP] Table below). Despite stronger economic data in recent weeks, Fed Chair Powell sees the 50bps cut as a “strong start and a sign that [the committee] is confident that inflation will fall [to the target rate of 2%] enabling a larger cut.” The time has come to “recalibrate [policy] to neutral (lower) rates over time”. There was only one dissent vote for a 0.25% rate cut, all others voted for 0.50%.

confident that inflation will fall [to the target rate of 2%] enabling a larger cut.” The time has come to “recalibrate [policy] to neutral (lower) rates over time”. There was only one dissent vote for a 0.25% rate cut, all others voted for 0.50%.

- While we thought the Fed might move more conservatively with a 0.25% cut, much of the rest of the messaging and projections played out as we expected.

- The Fed signaled it would reduce rates by 1.00% by the end of 2024.

- We thought the FOMC would increase it projections of cuts through 2025 to more than 1.25%. It raised the projection to 2.00% in cuts by the end of 2025, which would result in a Fed Funds rate of 3.25% to 3.50% (prime rate would fall to 6.50% and 30-year mortgages could fall to the 4.50% to 5.00% range). As expected, the Fed’s projections make it impossible for investors to predict how it will time these cuts over the next year.

- The Fed projects it will cease cutting rates in 2026 with the Fed Funds rate ending between 2.75% and 3.00% at the end of the cutting cycle.

MAJOR TAKEAWAYS

Inflation Falling to 2%

- Via the forecast above and statements during the press conference, the Fed made it clear that it expects it will take until 2026 for inflation to reach its target 2.0% rate. The job is not done until “people are no longer thinking about inflation”.

- It became apparent through questioning that the only problem area left for inflation is related to the housing market. Multi-family rent is slowly coming down, but Owner’s Equivalent Rent (OER) based on housing prices and mortgage costs remains elevated. Housing supply will have to increase to bring the annual increase in housing prices down. OER will take time to fall and lower mortgage rates may help. Powell conceded the Fed could not really fix this problem.

- Our Opinion: The Fed has deemed it is not worth waiting on a 2% inflation number because of stuck OERinflation, risking recession and higher unemployment. We think this is the right answer.

Future Rate Cut Cadence (More 50bps cuts on the way?)

Rob Hawkins, Chief Investment Officer, Independence Bank

- The Fed is signaling its confidence in inflation falling to 2% with the 50bps rate cut.

- FOMC members felt a 50bps cut was “timely” and committed to making a “strong move” to signal it is not behind on aiding the economy and “committed to not falling behind” as it did with tackling inflation in 2021- 2022. As usual, Powell stated the Fed is not committing to a series of 50bps cuts and does not believe the labor market is deteriorating enough to justify large moves. The Fed is not committing to any rate cut cadence. Its projections are the median of the FOMC members’ projections, not output from an economic projection model.

- Our Opinion: We believe the Fed’s 2024 projection to lower rates 1.00% by yearend. We think the Fed will make a 0.25% cut in the November and December meetings, but suspect the Fed may become more dovish than projected in 2025 and cut more than four times.

Labor Market Resilience

- Journalists questioned Powell about whether the “strong start” belied a greater concern about a deteriorating labor market. Powell outlined that quit rates, job openings and job creation still indicated strength in the labor market despite a drop in all of these statistics.

- Powell reiterated several times that the labor market remained resilient, but the Fed did not wish to fall behind in supporting the economy and the labor market by loosening financial conditions.

- Our Opinion: We believe the Fed is more concerned than it is indicating about the job market, because the data lag the changes in monetary policy. We believe job loss will exceed the 4.4% unemployment rate projection in coming quarters and the Fed will cut rates deeper than projected before the end of 2025.